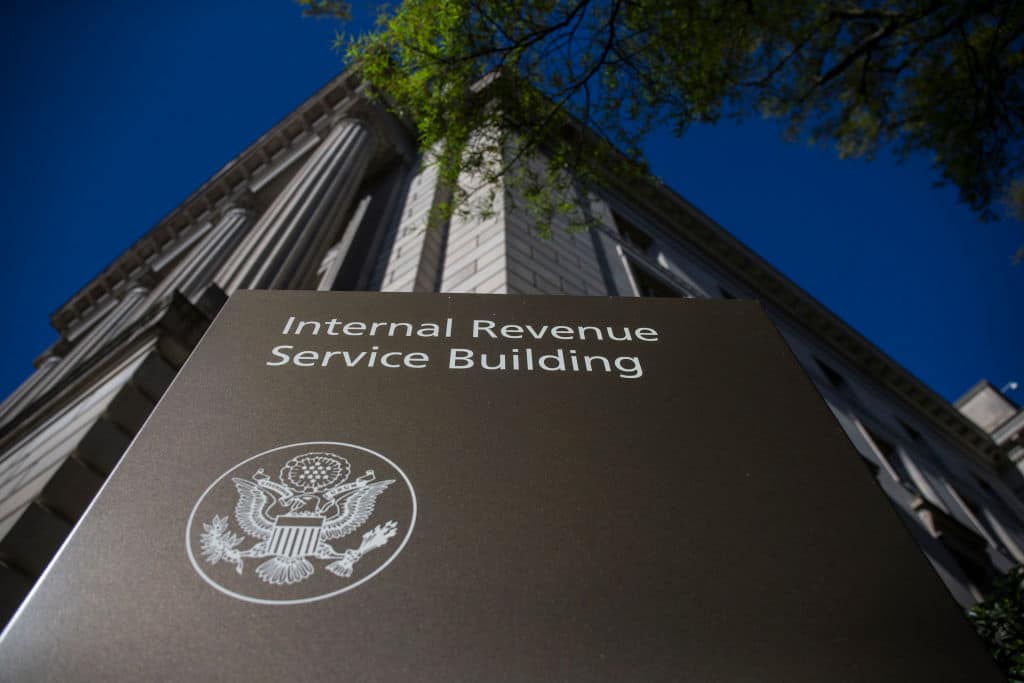

- Some Americans may have lower tax bills when they file for 2023 after the IRS adjusted tax brackets and increased deductions to counter the soaring price tags on groceries and other daily staples.

- Tax brackets will increase by about 7% in an attempt to counter rapid inflation, the IRS said in a statement on Tuesday.

- Those updated brackets could mean that Americans whose wages haven’t kept pace with inflation will land in lower brackets and owe relatively less when they file.

Trending

Inflation Causes IRS To Raise Tax Brackets, Standard Deduction By 7%